And you must also. AESOFT TECHNOLOGY SOLUTIONS - GST Tax Code for Malaysia 18 Aug 2016 Selangor Malaysia Kuala Lumpur KL Klang Supplier Suppliers Supply Supplies AESOFT.

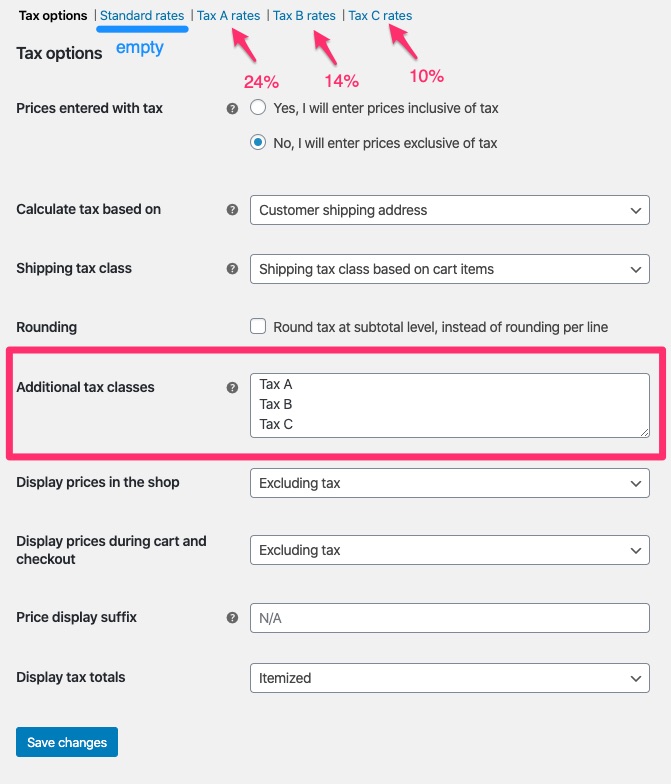

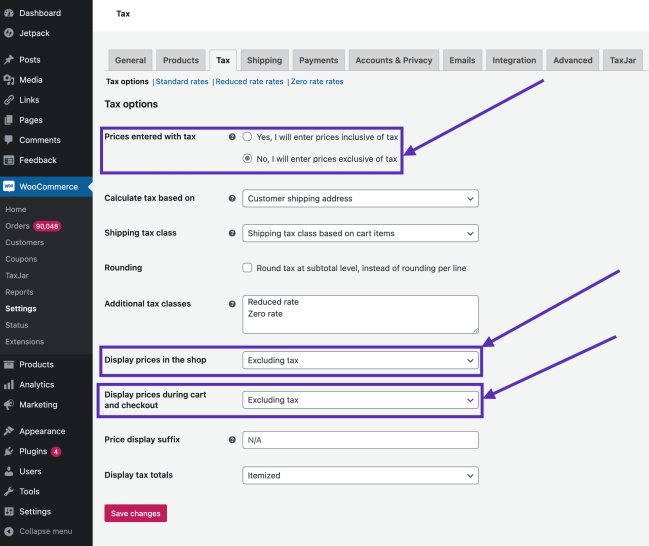

Setting Up Taxes In Woocommerce Woocommerce

In other countries GST is known as the Value-Added Tax or VAT.

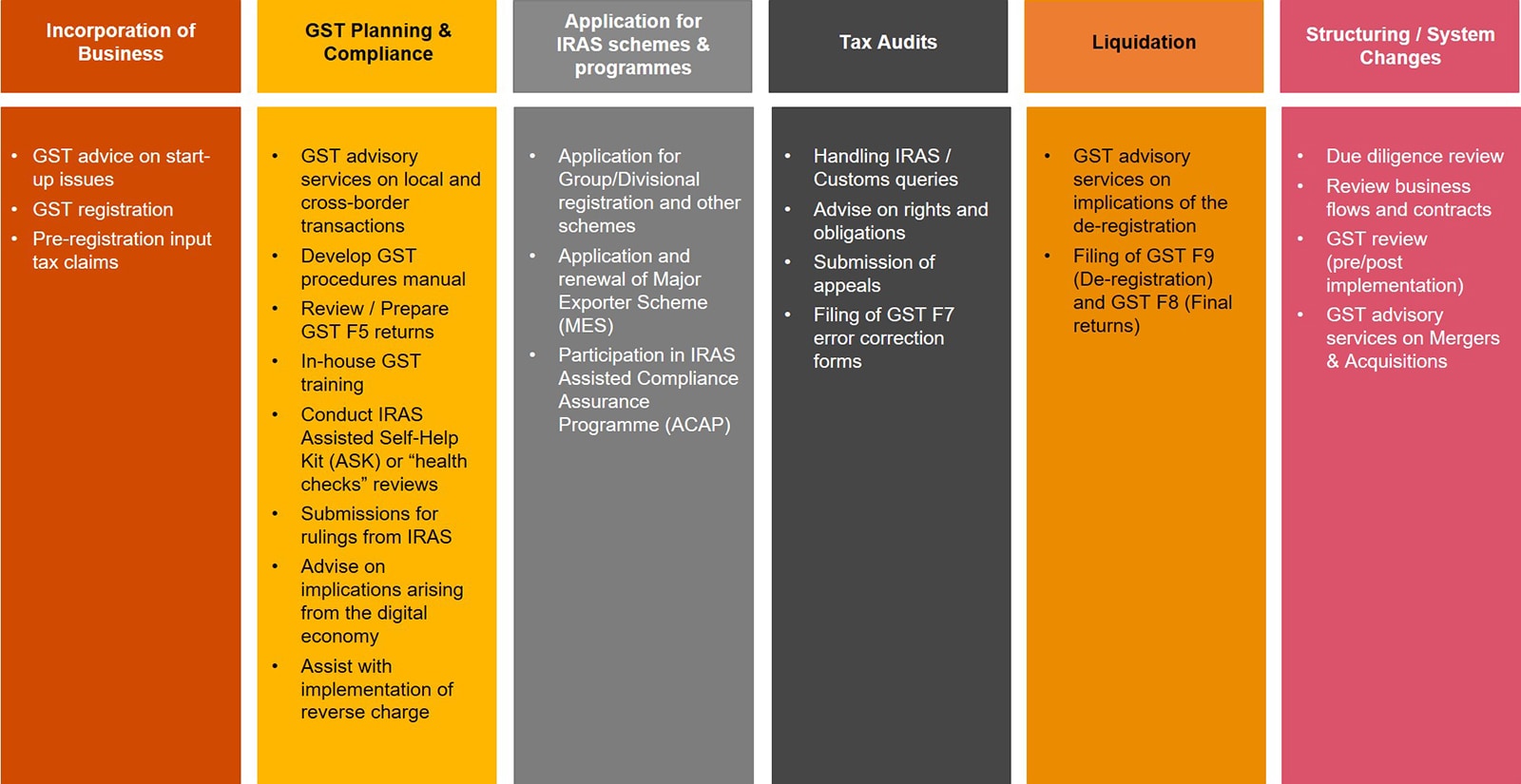

. Explanation of Government Tax Codes For Purchases. Purchase list by tax code. GST Tax Codes in MYOB.

There are 23 tax codes in GST Malaysia and categories as below. Malaysia reintroduced its sales and service tax SST indirect sales tax from. HSN Code List for GST.

Input Tax Not Claim ND. Ramlee 50250 Kuala Lumpur Malaysia. To view the GST Tax Codes in MYOB open your company file then click on Lists Tax Codes as shown in the image below.

The access to the tax code list menu is the. To understand how NetSuite uses the tax codes to get the values for the Malaysia GST-03 Return see What goes. Additionally a configurable GST report by configuration report is provided to meet the following reporting requirements.

Monthly Tax Deduction MTD 6. GST Tax Codes for. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input.

Real Property Gain Tax Payment RPGT 5. 1 Government Tax Code. Gst tax code list malaysia 2017 52022 dated March 25 2022 unveils an Amnesty Scheme 2022 to settle.

SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. For purchase of goods and services that are given relief under GST for example purchase of RON95 petrol.

A GST registered supplier can zero-rate ie. Exempt GST print code Specify the print code that is used for exempt GST codes. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018.

This article relates to the Goods Services Tax which was introduced in April 2015 but was subsequently replaced with the Sales Service Tax in September 2018. The following table shows the tax code properties required to correctly generate the Malaysia tax reports provided by the International Tax Reports SuiteApp and the Malaysia tax audit files. Supply of goods and services made in Malaysia that accounted for standard.

Here is a list of GST codes and terms that comply with the Australian BAS. Overview of Goods and Services Tax GST in Malaysia. Gst tax code list malaysia 2017 52022 dated March 25 2022 unveils an Amnesty Scheme 2022 to settle outstanding tax dues pertaining to the period before GST introduction.

Overview of Goods and Services Tax GST in Singapore. Purchases from farmers or fishermen registered under the Flat. Charging GST at 0 the supply of goods and services if they export the goods out of Malaysia or the services fall within the description of.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. The Goods and Services Tax or GST is a 10 tax that is placed on many items. What Is GST.

Income Tax Payment excluding instalment scheme 7. Input Tax 6 - GST incurred and choose not to claim the input tax. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST.

In order to understand the GST codes you must first understand what GST is.

How To Set Up Sales Tax In Quickbooks Online Youtube

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Eztax In Easiest Accounting In 8 Countries Accounting Software Accounting Online Accounting

Invoice Bill Sample Copy For Hotels Front Office Invoice Sample Invoice Template Word Invoice Template

Get Started With Tax Reporting Stripe Documentation

Sales Tax Guide For Online Courses

How To Collect And Pay Sales Tax In Quickbooks Desktop Youtube

How To Calculate Sales Tax For Your Online Store

Setting Up Taxes In Woocommerce Woocommerce